CFOs and Financial Advisors Have Different Concerns About Bitcoin

Recently surveyed finance executives are more worried about bitcoin (BTC)’s volatility, while US financial advisors are now seem to be more preoccupied with regulations, when it comes to investing in this booming asset class.

It was demonstrated this week when major research and advisory company Gartner released results of their recent survey of 77 finance executives (including 50 chief financial officers).

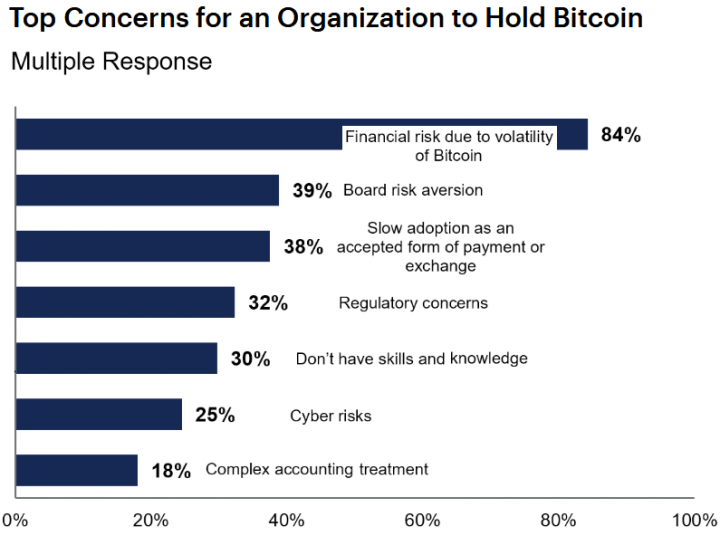

The survey showed volatility was the top concern by a large margin, at 84%. Other major issues pointed out by respondents included board risk aversion, with 39%, slow adoption as an accepted form of payment, at 38%, regulatory concerns, with 32%, and a lack of skills to invest in cryptocurrencies, at 30%. Other concerns were related to cyber risks, with 25%, and issues related to accounting, at 18%.

However, Gartner’s findings show a different hierarchy from the one presented in the latest report on US financial advisors and their crypto-related options released by the San Francisco-based digital asset management firm Bitwise.

“Regulatory concerns” topped the list of advisor worries for the second year in a row, with 54% of respondents highlighting regulation as a key barrier to allocating or increasing the existing allocation to cryptoassets. However, this was slightly down from 56% in Bitwise’s 2020 survey.

Price volatility is the second major concern for advisors, with 39%, down from 43% in 2020. Advisors also worry about their capacity to value cryptocurrencies, at 36%, down from 41% a year earlier. They are also concerned about the lack of “easily accessible investment vehicles like ETFs or mutual funds,” with 37%, down from 39%.

“There are a lot of unresolved issues when it comes to the use of bitcoin as a corporate asset. It’s unlikely that adoption will increase rapidly until we get more clarity on these challenges,” Alexander Bant, Chief of Research at the Gartner Finance practice